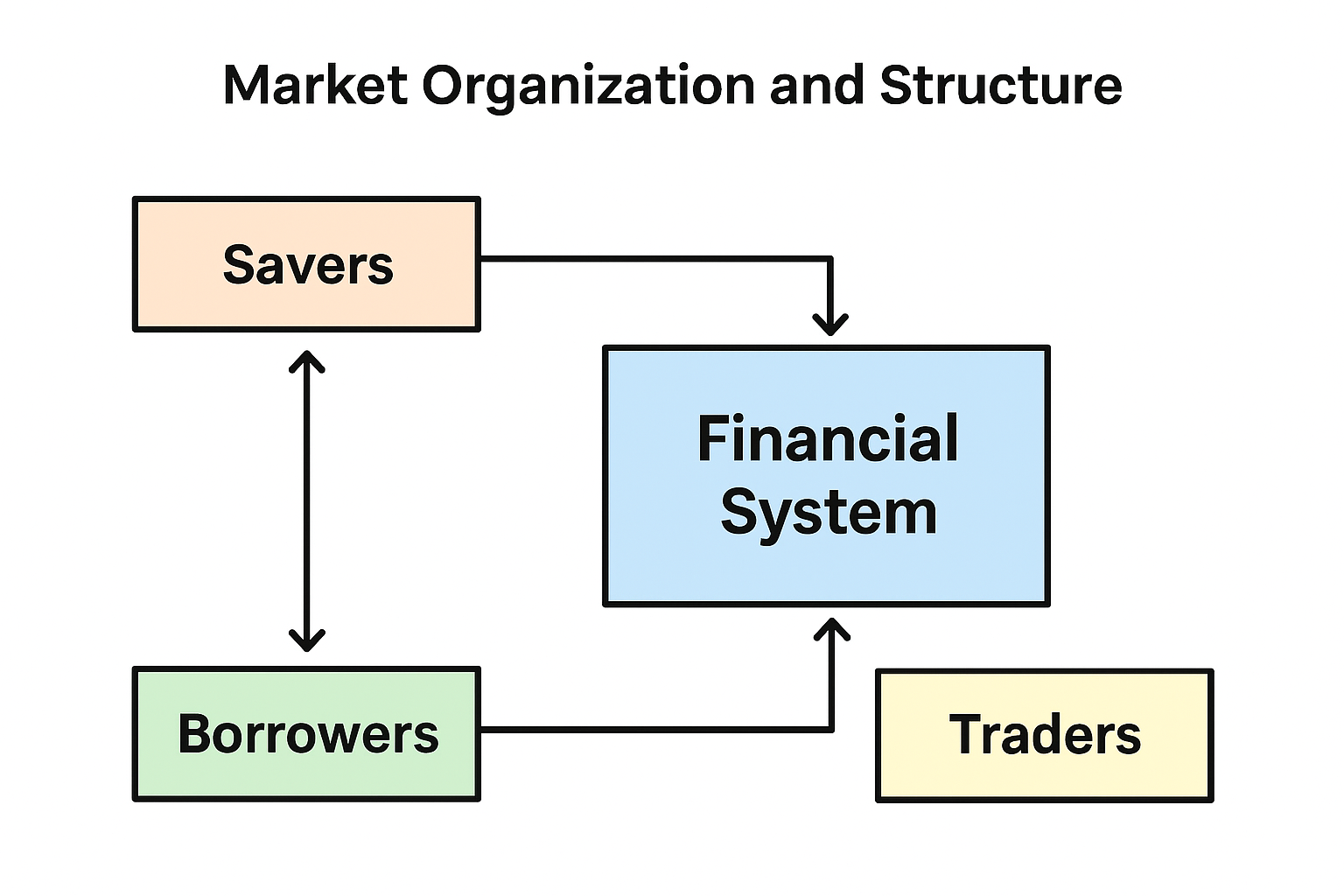

The Flow of Capital: How Savers, Borrowers, and Traders Interact in the Financial System

Market Organization and Structure

Introduction: Why Financial Markets Matter

Financial markets are where people and organizations buy and sell assets such as stocks, bonds, currencies, commodities, and real estate. Financial analysts study these markets to decide when to buy or sell, aiming to meet investment goals, manage risks, or raise money. For example, bond analysts assess economic conditions to choose the safest bonds, while corporate treasurers monitor exchange rates to decide when to convert currencies. Understanding how these markets work is essential for making sound financial decisions.

The Main Functions of the Financial System

The financial system connects savers, borrowers, investors, and traders. People use it for six main purposes:

- Saving for the Future – Individuals and companies often want to keep money now to use later. Workers save for retirement, and companies set aside funds for future investments. They use instruments like bank deposits, bonds, and stocks to earn returns while they wait.

- Borrowing for Current Needs – Sometimes people, businesses, or governments need money now that they don’t have. They can borrow from banks or sell bonds, promising to repay later, often with collateral to reduce borrowing costs.

- Raising Equity Capital – Companies can raise money by selling ownership shares (equity). This doesn’t require repayment like a loan but gives investors a claim on future profits. Investment banks, analysts, and regulators help make this process fair and efficient.

- Managing Risks – Businesses and investors face risks such as price changes in commodities, interest rates, or currencies. They can hedge using contracts like futures or options. For example, a farmer and a food processor can agree on a fixed future price for grain to avoid market volatility.

- Spot Market Trading – In spot markets, assets are exchanged for immediate delivery, such as converting dollars to euros or buying gold to protect against inflation.

- Information-Motivated Trading – Traders sometimes act on unique research or insights to buy undervalued assets or sell overvalued ones, aiming for returns higher than the market average.

Three Core Roles of the Financial System

- Helping Achieve Financial Goals – The system enables people to move money through time, manage risks, and exchange assets efficiently.

- Determining Rates of Return – Interest rates balance the supply of savings with the demand for funds. High rates encourage more saving but make borrowing expensive; low rates do the opposite. The “equilibrium interest rate” is where supply and demand meet.

- Efficient Capital Allocation – A healthy financial system directs funds to the most productive projects. When investors have accurate information, money flows to projects that create more value than they cost. Poor information can lead to wasted capital or missed opportunities.

Real-World Examples

- A CFO deciding how to finance a factory expansion might compare borrowing from a bank versus issuing new shares.

- A grain farmer and food processor can both eliminate price uncertainty by locking in a future selling price.

- A pension fund manager focuses on earning a fair long-term return, while an active trader seeks extra returns from timely information.

Conclusion: What Makes a Good Financial System

A well-functioning financial system has low transaction costs, high liquidity, transparent information, and effective regulation. It allows savers to invest confidently, borrowers to access funds, and businesses to manage risks. In turn, this supports long-term economic growth and stability. For students, understanding these principles is a first step toward making smarter personal and professional financial choices.

TechStockTrade

TechStockTrade