Why the Stock Market Might Be Falling on Purpose — And What It Means for Beginner Investors

Why is the stock market dipping sharply while long-term bond ETFs are suddenly surging? Could it be part of a deliberate strategy? Let’s break down a compelling (and slightly conspiratorial) theory that may help beginner investors understand short-term market chaos — and how to stick to smart, long-term investing strategies despite the noise.

🧠 Key Takeaway for Beginner Investors

Even when market news seems driven by politics or panic, sticking to long-term investing principles and diversified assets like the best ETFs for 2025 can help you stay steady and smart with your money.

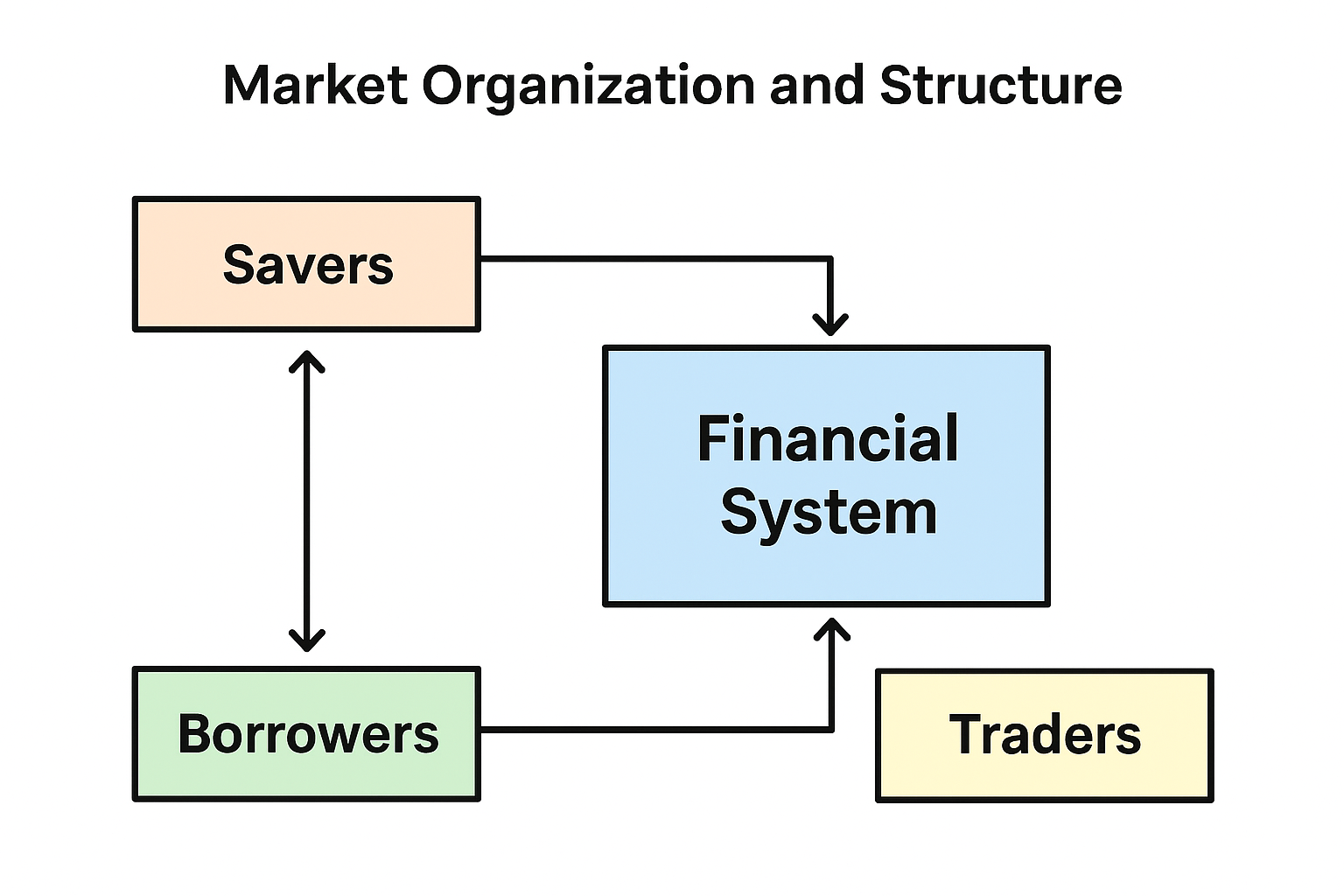

The Theory: Market Volatility as a Debt Strategy

The U.S. Faces Massive Short-Term Debt Obligations

- Over $7 trillion in short-term U.S. government debt is due within six months.

- The government must either repay this or refinance it.

- But refinancing is expensive when interest rates (like the 10-year Treasury yield) are high.

How Lower Interest Rates Help

- Lower interest rates reduce the cost of refinancing.

- To push rates down, money needs to flow into safe assets like bonds.

- When investors flee stocks out of fear, they often buy bonds — driving bond prices up and interest rates down.

The Suspected Play: Create Fear, Lower Rates

Could This Be Intentional?

Some analysts suggest a strategy:

- Use political events (like trade wars) to trigger market fear.

- Fear drives investors out of stocks and into bonds.

- Bond demand rises → bond yields fall → government borrows at a lower cost.

This theory isn’t official policy — but it's surprisingly plausible.

Recent Market Moves Support the Story

What’s Happening:

- Major stock indexes (like NASDAQ) fell after new trade war rhetoric.

- Long-term U.S. bond ETFs like TLT surged in price — a clear sign investors are moving into bonds.

- Interest rates on 10-year Treasuries dropped significantly, lowering refinancing costs for the government.

What This Means for Long-Term Investors

Don’t Get Distracted by Headlines

Political drama and economic maneuvers may shake the market in the short term — but for beginner investors, here’s what matters:

✅ Focus on the Fundamentals

- Invest in low-cost index funds or top ETFs for 2025

- Stick to a long-term investing plan

- Avoid trying to “time the market”

📈 Use Volatility as an Opportunity

- Down markets = potential discounts on quality investments

- If you're investing for the next 10–30 years, short-term dips can work in your favor

🛡 Diversify Your Portfolio

- Include a mix of stocks, bonds, and international assets

- Consider ETFs with broad exposure across sectors or countries

Best Beginner Investing Tips (2025 Edition)

Here are some timeless principles:

1. Start Early, Even with Small Amounts

Thanks to compounding, time matters more than timing.

2. Invest Regularly

Use dollar-cost averaging to reduce the risk of buying at market highs.

3. Use Tax-Advantaged Accounts

Think IRAs or 401(k)s (or local equivalents) to boost after-tax returns.

4. Choose Simple, Low-Fee ETFs

Look into ETFs like:

- VTI (Total U.S. Stock Market)

- VOO (S&P 500)

- VXUS (International Markets)

- TLT (Long-Term Bonds, if seeking diversification)

5. Stay Calm During Market Drops

Downturns are part of the game — successful investors stay the course.

Final Thoughts: Ignore the Noise, Trust the Process

Whether or not the market dip is part of a political strategy, one thing remains clear: trying to outguess short-term moves is a losing game. For beginner investors, the best approach is to:

- Stay diversified

- Keep investing regularly

- Focus on your long-term goals

TechStockTrade

TechStockTrade