Assets and Contracts: The Building Blocks of Financial Markets

1. Introduction: Why They Matter

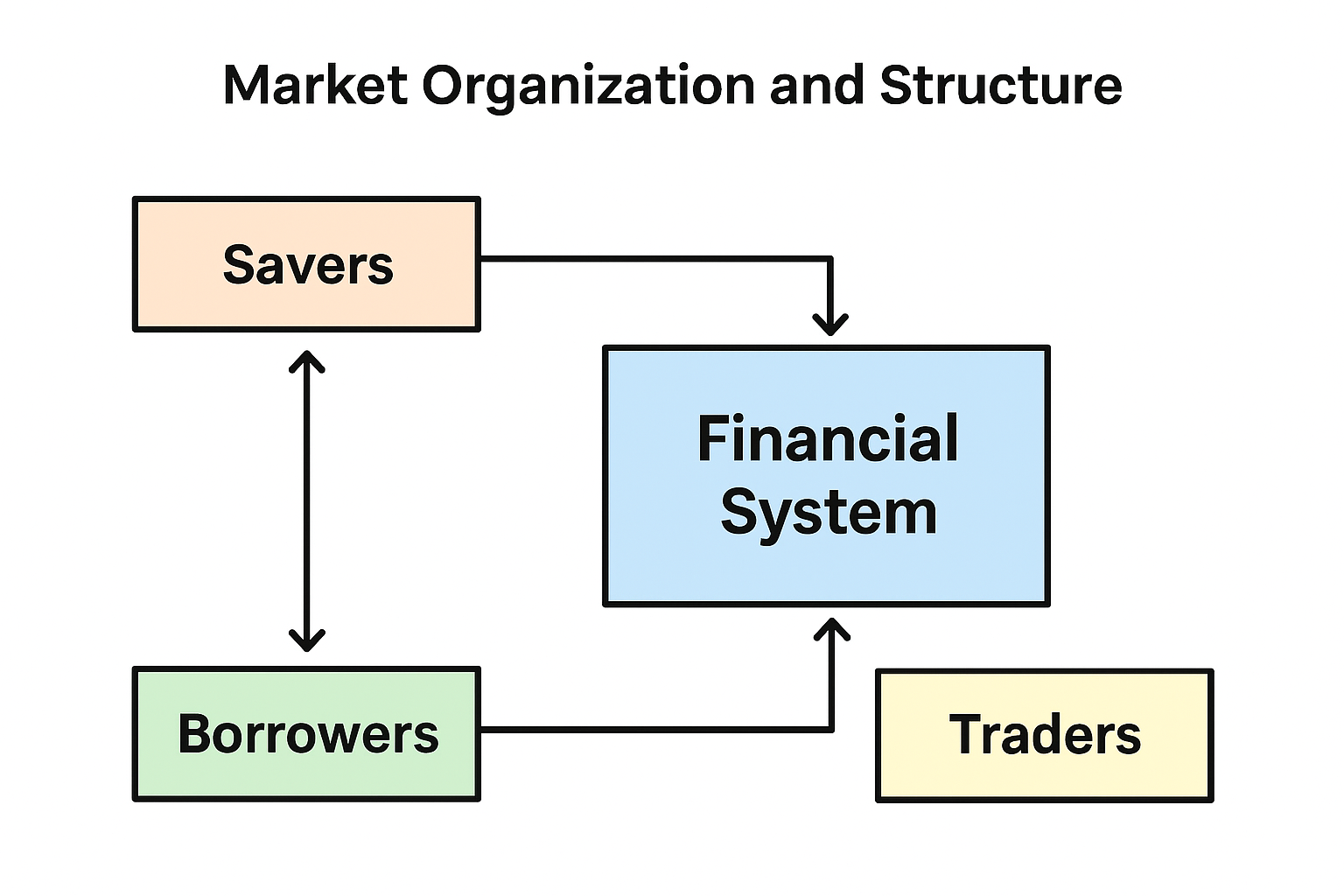

People, companies, and governments all have goals that require money — such as building a factory, saving for retirement, or funding public projects. To reach these goals and manage risks, they use different assets and contracts. These tools can help raise money, invest for growth, protect against losses, or simply move funds from one form to another.

2. Types of Assets

2.1 Financial Assets

These are claims on future money. Examples include bank deposits, loans, bonds, and stocks. Bonds are promises to repay borrowed money with interest, while stocks represent ownership in a company.

2.2 Currencies

These are official monies issued by governments or central banks, like the US dollar or euro. People trade them in foreign exchange markets.

2.3 Commodities

These are physical goods like gold, oil, wheat, or copper. Their prices often change based on supply and demand.

2.4 Real Assets

These are tangible things like real estate, airplanes, or machinery. They can generate income or appreciate over time.

Key Distinction: Financial assets (securities, currencies) exist on paper or electronically, while commodities and real assets are physical.

3. Types of Contracts

Contracts are agreements with terms that determine future exchanges. Many are derivatives, meaning their value depends on something else (the “underlying asset”).

Common types:

- Options: Right (not obligation) to buy or sell later.

- Futures and Forwards: Agreement to trade in the future at a fixed price.

- Swaps: Exchange of cash flows (like interest payments).

- Insurance: Payment if certain events happen.

4. Securities in Detail

- Debt vs Equity: Debt is borrowed money to be repaid; equity is ownership.

- Public vs Private: Public securities trade on exchanges and meet strict regulations; private securities are sold directly to specific investors.

- Liquidity: Public securities are often easy to sell; private ones are harder to trade.

- Venture Capital: A form of private equity funding early-stage companies.

5. Market Types

- Spot Market: Immediate delivery.

- Forward/Futures Market: Delivery in the future.

- Options Market: Delivery only if the option is exercised.

- Primary Market: Issuer sells directly to investors (e.g., IPO).

- Secondary Market: Investors trade with each other.

- Money Market: Short-term debt (maturity ≤ 1 year).

- Capital Market: Long-term debt and equity.

6. Traditional vs Alternative Investments

-

Traditional: Public stocks, bonds, ETFs.

-

Alternative: Hedge funds, private equity, real estate, commodities, collectibles.

Alternatives can be harder to value and trade but may offer unique returns.

7. Case Study: Mutual Fund Rules

If a mutual fund can only buy public equities in secondary markets:

- ✅ It can buy common stock on a major exchange.

- ✅ It can buy public stock traded through dealers.

- ❌ It cannot buy government bonds (not equity).

- ❌ It cannot buy futures (derivative, not equity).

- ❌ It cannot buy newly issued stock in the primary market.

- ❌ It cannot buy private company shares.

8. Conclusion

Assets and contracts are the foundation of modern finance. Understanding them helps investors see how money flows, how risks are managed, and how opportunities are created. Whether you’re an individual saver or a global corporation, these tools shape every financial decision.

TechStockTrade

TechStockTrade